The information here is a summarized version of a paper titled ‘Are you a DePIN? A Decision Tree to Classify Decentralized Physical Infrastructure Networks‘ found in full here. Special thanks to my co-author Mr. Mark Ballandies for his contributions. Thanks too to Max, Gator Green, Decentralized Rob, and spillere for their inputs and opinions.

Distributed infrastructure has a fascinating history that stretches back to the late 1990s, when pioneering projects like distributed.net and SETI@home first explored the concept of harnessing idle computer power for scientific endeavors. SETI@home, in particular, captured the imagination of volunteers worldwide by inviting them to contribute their computers’ processing power to analyze radio signals for signs of extraterrestrial intelligence. This groundbreaking project marked one of the earliest and most successful uses of distributed infrastructure in scientific research.

More recently, blockchain technology, propelled into the spotlight by cryptocurrencies like Bitcoin, has leveraged distributed infrastructure to create secure and tamper-resistant networks. In the world of blockchain and web3, innovative systems like Helium have ushered in a new era of markets that incentivize the deployment of specialized hardware through payment in blockchain tokens. This blend of cryptocurrency and distributed infrastructure has given rise to a new sector known as Decentralized Physical Infrastructure Networks (DePIN), perhaps you have heard of it by now 😉

Before the term ‘DePIN’ gained widespread usage, similar real-world blockchain systems were known by various names, such as MachineFi, Proof of Useful Work, and Token-Incentivized Physical Infrastructure Networks (TIPIN). However, ‘DePIN’ gained popularity following its adoption by research firm Messari, spurred by an informal poll on Twitter. Despite its widespread adoption, there is still no universally agreed-upon definition, leading to its use in a variety of contexts, including marketing materials and descriptions of systems like Bitcoin.

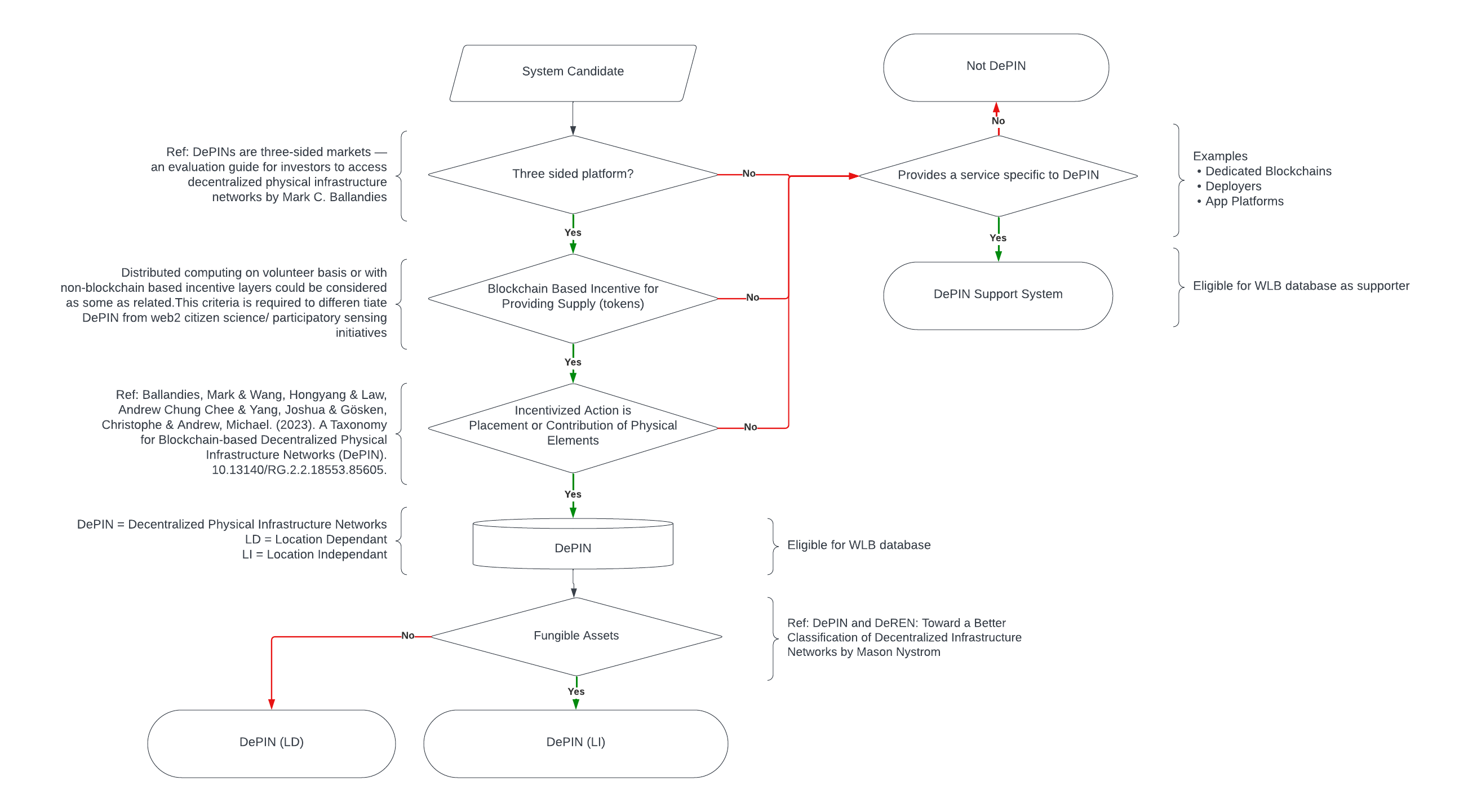

There are sure to be further discussions (or arguments) about what it means to be a DePIN. Discussions are already common on a variety of social platforms and within academia. Setting that aside, to be classified as a DePIN for the purposed of eligibility for the Who Loves Burrito? project database, a system must meet three main criteria (See the full paper for additional details):

- Three-Sided Platform: DePIN systems can be characterized as three-sided platforms (A side of a platform is defined as an interface to a distinct user-group) consisting of a supply, a service and a demand side in which the supply-side is decentralized by creating a market that incentivizes a community to provide infrastructure resources. In particular, in a DePIN system the supply is provided by different actors than those maintaining the service of the system. This differentiates DePIN systems from L1 blockchain networks where the miner/ consensus participants directly provide the supply to users, thus removing the intermediary, hence exhibiting a two-sided platform layout.

- Token-Based Incentives for Supply: The suppliers in a DePIN are incentivized to contribute infrastructure by earning blockchain-based tokens. These tokens hold value within the network and can be used for various purposes, such as accessing services or trading on exchanges. This is a key factor that sets DePIN apart from web2 citizen science or participatory sensing initiatives. DePIN projects can more easily incentivize infrastructure build-out (see next criterion) through these token-based compensation, as they are attractive to suppliers for their speculative value and potential for appreciation, even before market demand emerges.

- Incentivized Core Economy Action is Physical Assets Placement: In a DePIN, the core economic activity is the placement or contribution of physical infrastructure assets to the system. These physical assets can take many forms such as sensors, cameras, storage drives, and processors. This criterion is required to differentiate DePIN from other Web3 verticals such as regenerative finance (ReFi) or decentralized science (DeSci). By separating the supply side from service side and incentivizing with blockchain tokens (see above criteria) a network of physical assets can potentially be deployed quickly and efficiently.

The combination of the above criteria fuels the ‘Flywheel’ system that is considered the main engine of DePIN systems. If a system doesn’t meet all of these criteria but provides a service specific to a DePIN, it is considered a DePIN support system for the purposed of the database.

Based on the definitions provided by DePIN and DeREN: Toward a Better Classification of Decentralized Infrastructure Networks and the reasoning presented by State of DePIN 2023, these systems can be further divided into two sectors:

- Fungible Assets (DePIN-LI – Location Independent): In these systems, physical assets placed in the system are interchangeable. For example, in a decentralized storage system like Akash, the specific location of the storage drive isn’t critical. If one storage drive goes offline, it can be replaced with another from any location without much impact on functionality. In fact, in theory, all of the drives could be in one place.

- Non-Fungible Assets (DePIN-LD – Location Dependent): These systems involve physical assets that are not interchangeable. For instance, consider a project like onocoy or GEODNET, which are GNSS positioning projects. If the antenna is removed, the system loses data from that specific site (though this may or may not cause lack of coverage depending on location of other antennas and redundancy).

Case Studies

The below table illustrates a selection of systems in alphabetical order that could potentially fall under the term DePIN:

The Akash Network is a decentralized cloud computing platform that aims to provide a more efficient and cost-effective alternative to traditional cloud providers (e.g. Amazon Web Services). There are several other decentralized compute and storage systems that offer a similar type of supply to the market for compute services and the Akash assessment can serve as a proxy for these other similar services. Akash creates a three-sided market place between suppliers and users of compute by providing a marketplace for connecting the suppliers and users. Contribution of physical compute assets are incentivized with the blockchain-based AKT token. Because the compute assets are fungible, Akash is classified as a DePIN-LI.

The Climate City Cup (CCC) is a citizen science/ participatory sensing initiative to crowd-source air quality data in cities by incentivizing a friendly competition among the participating parties. On the supply side are the sensors placed by citizens, the service side is provided by CCC which aggregates the data, and on the demand side are policy makers. Though the initiative motivates the placement of physical non-fungible sensors, it does not incentivize participation with blockchain-based tokens. In the literal sense, this would be a decentralized infrastructure network, which, however, as already mentioned, does not correspond to the purpose of the currently observed designation ’DePIN’, which requires token-based incentives.

Data Lake is a decentralized science (DeSci) system that incentivizes the sharing of patient data with researchers. Though it uses blockchain-based tokens to crowd-source data (supply), it does not incentivize the placement of physical infrastructure, thus it is not considered a DePIN.

Grass markets itself as selling an unused resource (e.g. extra internet bandwidth). Essentially, the software uses your IP address and internet connection to ’scrape’ the web on behalf of the market side buyers. On the supply side are users who provide a computing device with capability to run a web-browser. Grass provides the service and sells to businesses that are interested to use the web scraped data (e.g. using it to train AI). Contributed computing assets are fungible, thus making Grass a DePIN-LI system.

Helium started as a decentralized wireless network focused on IoT (Internet of Things). Helium is now divided into two networks governed by separate sub-DAO. In this case, we are examining the IOT network (with IOT token as utility) but the findings are generally the same for the Mobile network (MOBILE token). Not surprisingly, Helium IOT is an uncontroversial DePIN system. As shown in Figure 1, it meets all the attributes to be a DePIN, and specifically a DePIN-LD. Bitcoin can certainly be considered physical (in terms of miners), decentralized, and token-incentivized (earn BTC). However, the spirit of DePIN, is that the service within the three-sided market is provided by others than those contributing the supply. In particular, Bitcoin can be considered as a two-sided market where those contributing the supply make up the platform that is given as a service to customers.

IoTeX and Peaq are L1 blockchains purposely built to service DePIN. What differentiates these from other L1s are the ’add-ons’. For example, peaq refers to these as “easy-to-use Modular DePIN Functions”. Despite these DePIN-centric extras, like Bitcoin, these blockchains can be considered a two-sided market where those contributing the supply make up the platform that is given as a service to Web3 customers, thus not meeting the first criteria. However, both explicitly offer DePIN-focused services and have DePINs built on them, which classifies them as DePIN support systems.

WiHi consists of a three-sided market that collects weather data via physical non-fungible weather stations on the supply side and applies machine learning to it via its expert community; both are offered to users as a service. The supply side is incentivized with a token, making WiHi a DePIN-LD.

Wrap Up

The purpose of creating a more formal definition is to provide unbiased, objective, and repeatable ‘litmus test’ to determine if projects are eligible for listing in our neutral clearinghouse for the DePIN sector. Absent of this, subjective decisions regarding inclusion may be considered as arbitrary and potentially biased. Who Loves Burrito? strives to be uncluttered by marketing claims and focus on providing clear information for our users. That said, we are always up for discussion and never mind disagreements (discussed in a civilized manner of course).